22+ Calculating Sharpe Ratio

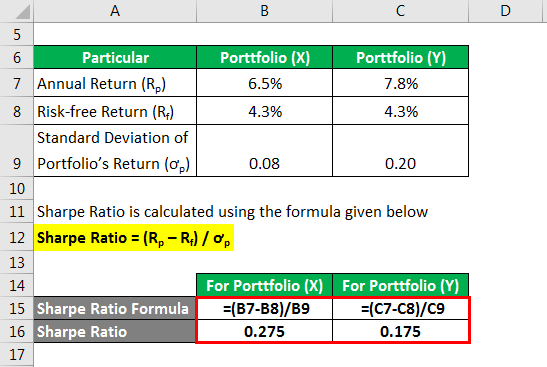

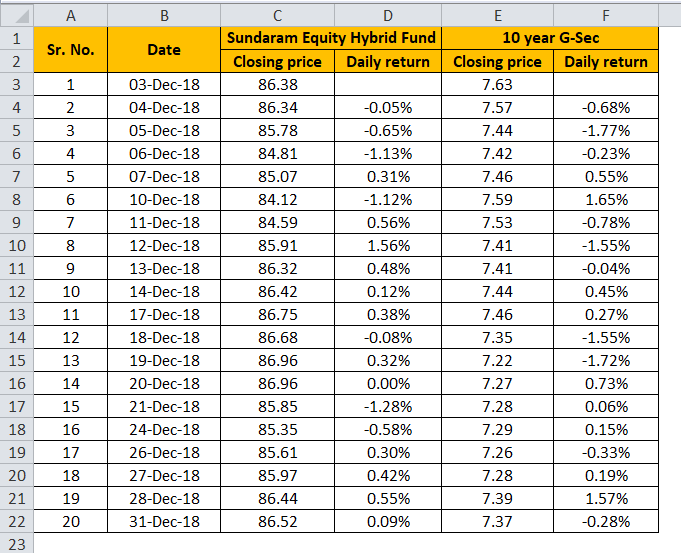

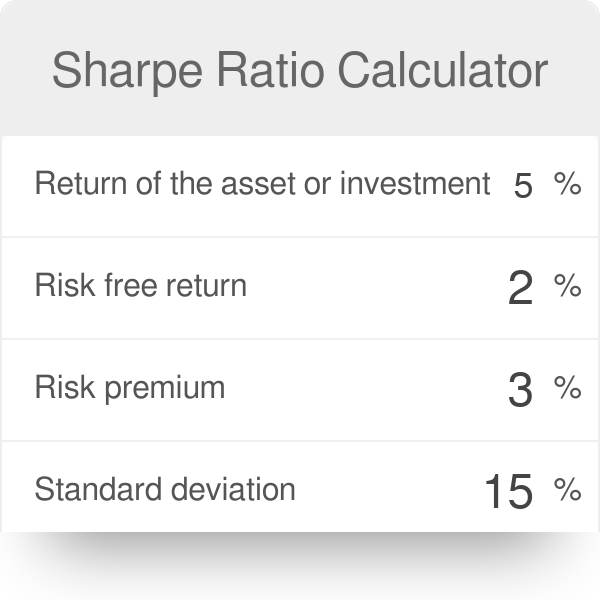

What is Sharpe Ratio. The Sharpe Ratio formula is calculated by dividing the difference of the best available risk free rate of return and the average rate of return by the standard deviation of the portfolios return.

Sharpe Ratio Calculator Efinancemanagement Com

In calculating the Sharpe ratio analysts typically use the rate for T-bills or cash.

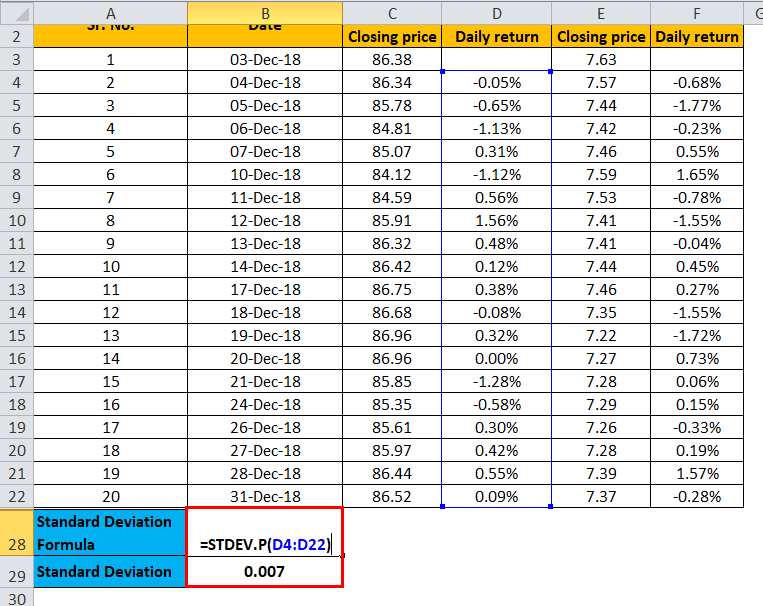

. It allows us to use mathematics in order to quantify the relationship between the mean daily. The Sharpe ratio is the average return earned in excess of the risk-free rate per unit of volatility in the stock market volatility represents the risk of an asset. Calculating sharpe ratio for shares is a straight forward task.

Average returns - risk free standard deviation. Sharpe ratio is a measure for calculating risk-adjusted return. However i remain baffled as to how to tackle the task for options can someone please advise regarding this.

The ratio can be used to evaluate a single stock or investment or an entire portfolio. Consider the following example to obtain returns for American options. To calculate the Sharpe Ratio find the average of the Portfolio Returns column using the AVERAGE formula and subtract the risk-free rate out of it.

The Sharpe Ratio calculation 15 - 03 20 073. Step 1 - shares of xyz cost. The information derived from the Sharpe Ratio calculation can be used for various purposes.

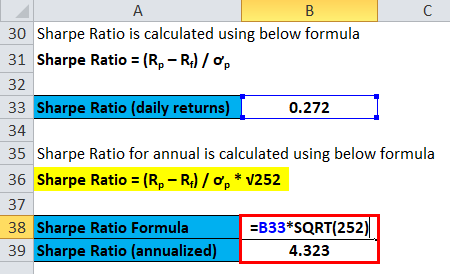

The Sharpe ratio named after William Forsyth Sharpe is a measure of the excess return or risk premium per unit of risk in an investment asset or a trading strategy. If we put the steps from the prior section together the formula for calculating the ratio is as follows. In this article I will show you how to use Python to calculate the Sharpe ratio for a portfolio with multiple stocks.

To annualize the variance you multiply by 252 because you are assuming the returns are uncorrelated with each other and the log return over a year is the sum of the daily log returns. Uses of the Sharpe Ratio. The Sharpe ratio is used.

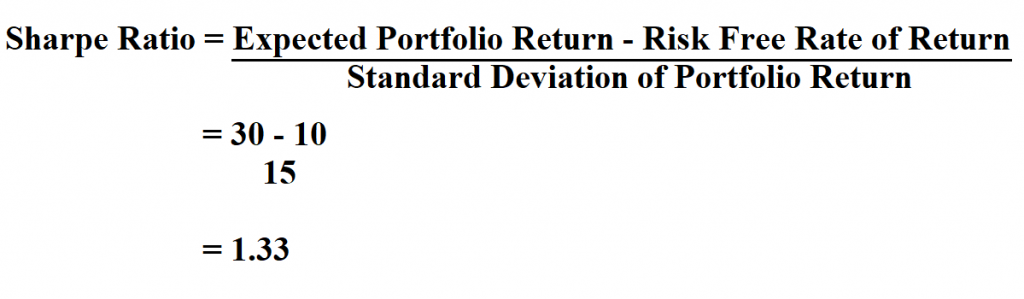

Sharp Ratio actual return - risk-free return standard deviation Sharpe Ratio Definition This online Sharpe Ratio Calculator makes it ultra easy to calculate the Sharpe Ratio. Sharpe Ratio Sharpe Ratio Formula Sharpe Ratio Rx Rf StdDev Rx Where. The 90-day T-Bill rate is a particular favorite in representing the risk-free rate.

It is the ratio of the excess expected return of the investment over risk-free rate per unit of volatility or. Sharpe Ratio Rp Rf σp.

Sharpe Ratio Calculator

What S The Best Period To Use For Standard Deviation When Calculating Sharpe Ratio Quora

Maximum Sharpe Ratio Available From Market Timing Download Table

Demo Zone Lc Moody S Live

Sharpe Ratio Implications Of Sharpe Ratio For Excess Rate Of Return

Sharpe Ratio Formula Calculator Excel Template

Sharpe Ratio Formula Calculator

Sharpe Ratio Formula Calculator Excel Template

Sharpe Ratio Formula Calculator Excel Template

How To Calculate Sharpe Ratio

Sharpe Ratio Calculator

Sharpe Ratio Formula Calculator

Sharpe Ratio Explained How To Calculate Risk Adjusted Returns

Modern Portfolio Management Using Capm Fama French Model Epat Project

Modern Portfolio Management Using Capm Fama French Model Epat Project

Pdf Review Of Particle Physics Georg Raffelt Academia Edu

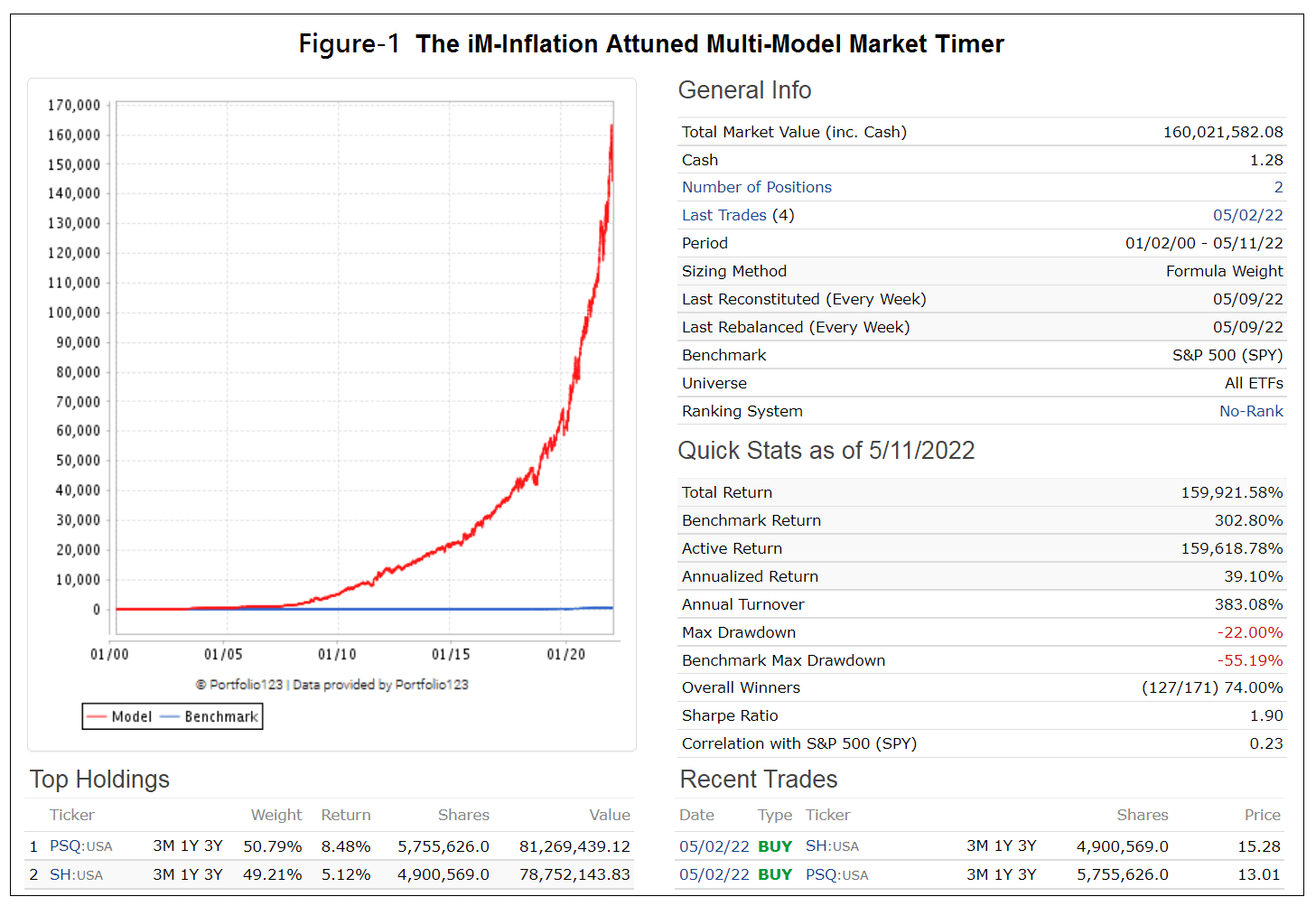

The Im Inflation Attuned Multi Model Market Timer Imarketsignals